When you’ve been injured in an accident that wasn’t your fault, one of the first questions that comes to mind is “How long does a personal injury claim take?”

It’s a fair question. You’re likely facing medical bills, lost wages, emotional stress, and perhaps even the frustration of dealing with insurance companies. Knowing how long it will take to receive your compensation helps you plan your recovery and financial future more confidently.

But here’s the thing: there’s no one-size-fits-all answer. The duration of a personal injury claim depends on a variety of factors — from how severe your injuries are to whether the other party accepts responsibility. Some cases wrap up in just a few months, while others can stretch over several years, especially if they end up in court.

In the UK, for instance, according to the Association of Personal Injury Lawyers (APIL), straightforward claims can take around 6–12 months, while more complex or serious injury cases may take 2–3 years or longer. The same general range applies in most countries with similar legal systems.

To make things clearer, this guide will walk you through each stage of the personal injury claim process, explain what can speed things up or slow them down, and provide realistic timelines so you know exactly what to expect.

Quick Fact: Over 90% of personal injury claims settle before reaching court, according to Law Society data. That’s great news if you’re worried about a drawn-out legal battle.

Contents

- What Is a Personal Injury Claim?

- Common Types of Personal Injury Claims

- Why Personal Injury Claims Exist

- Who Can File a Personal Injury Claim?

- The Goal of a Personal Injury Claim

- How Long Does a Personal Injury Claim Usually Take?

- Key Stages of a Personal Injury Claim Process

- Factors That Affect How Long a Personal Injury Claim Takes

- How to Speed Up a Personal Injury Claim

- How Long Does It Take to Settle Out of Court?

- Factors That Can Delay a Personal Injury Claim

- How Long Does It Take to Receive Compensation After Settlement?

- Common Mistakes That Can Delay Your Personal Injury Claim (and How to Avoid Them)

- Frequently Asked Questions (FAQs)

- Conclusion: How Long Does a Personal Injury Claim Take Overall?

What Is a Personal Injury Claim?

A personal injury claim is a legal process that allows you to seek compensation when you’ve been injured due to someone else’s negligence or wrongdoing. In simple terms — if another person, company, or authority caused your injury (even partly), you may have the right to claim financial damages.

This compensation is designed to restore you to the position you were in before the accident, at least financially. It covers things like:

- Medical expenses (both current and future)

- Lost wages or income

- Pain and suffering

- Property damage

- Rehabilitation or long-term care costs

Think of it as your way of holding the responsible party accountable — not out of revenge, but to ensure you’re not left carrying the financial burden of someone else’s mistake.

Common Types of Personal Injury Claims

There are several scenarios where people commonly file personal injury claims:

| Type of Claim | Example | Typical Responsible Party |

|---|---|---|

| Road traffic accidents | Car or motorcycle crashes | Another driver, cyclist, or pedestrian |

| Workplace injuries | Falls, unsafe equipment, lack of safety training | Employer |

| Public liability accidents | Slipping in a supermarket or park | Business owner or local council |

| Medical negligence | Incorrect diagnosis, surgical error | Hospital or healthcare provider |

| Product liability | Injury from a defective product | Manufacturer or retailer |

These are just a few examples. In reality, any situation where another person’s negligence caused you harm may qualify as a personal injury case.

Why Personal Injury Claims Exist

The concept isn’t new — it’s rooted in centuries-old legal principles. The idea is simple: if someone’s careless actions hurt you, they should pay to make it right.

“Compensation isn’t about getting rich — it’s about getting your life back.”

— A common saying among personal injury solicitors.

Filing a claim also promotes accountability. When individuals or organizations face financial consequences for negligence, they’re more likely to improve safety standards, prevent future accidents, and protect others.

Who Can File a Personal Injury Claim?

You can usually file a claim if:

- You were injured in the last three years (this is the standard limitation period in many regions such as the UK — though it may vary internationally).

- The injury was partly or fully caused by someone else’s fault.

- You suffered measurable damages — physical, emotional, or financial.

If you’re under 18, a parent or guardian can make the claim on your behalf. In cases involving serious or fatal injuries, close family members may be able to pursue the claim as dependents or representatives.

The Goal of a Personal Injury Claim

The ultimate goal isn’t just compensation — it’s justice and recovery.

A well-handled claim ensures:

- You’re not left paying out of pocket for injuries you didn’t cause.

- You can access medical care, therapy, and rehabilitation faster.

- You receive fair recognition for the emotional and physical impact of your accident.

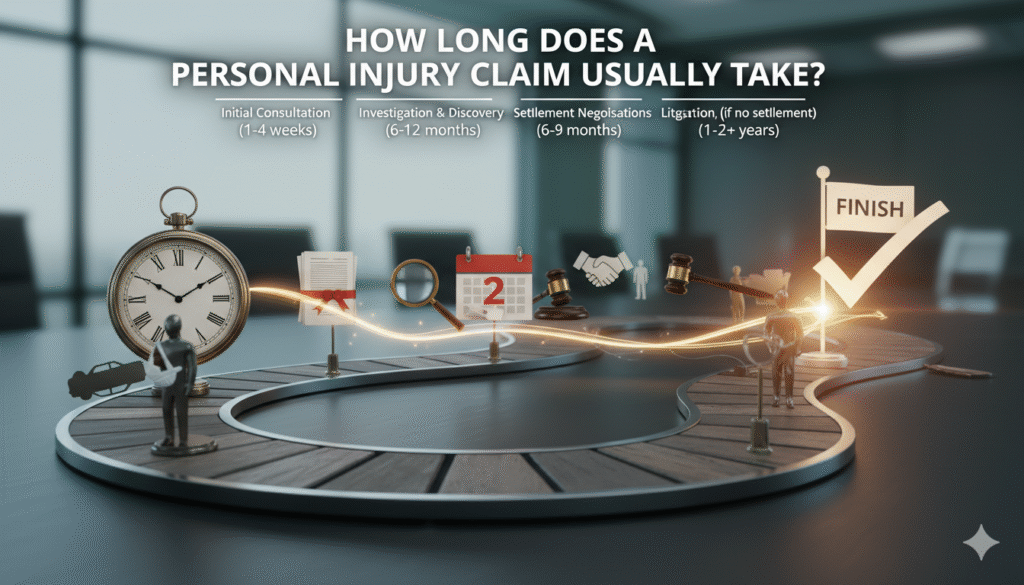

How Long Does a Personal Injury Claim Usually Take?

Now that we understand what a personal injury claim is, the big question remains: how long does a personal injury claim take from start to finish?

The short answer — it depends.

Every case is different. Some people receive compensation within a few months, while others wait years, especially when liability is disputed or the injury is severe. However, we can look at general trends and averages to help you understand what’s typical.

The Typical Timeline at a Glance

Here’s a quick overview of how long most personal injury claims take to settle:

| Claim Type | Average Duration | Complexity Level | Example Scenario |

|---|---|---|---|

| Minor injury claims | 3–6 months | Low | Whiplash, minor slip and fall |

| Moderate injury claims | 6–12 months | Medium | Broken bones, workplace injury |

| Serious injury claims | 1–3 years | High | Spinal, brain, or long-term disability injuries |

| Court trial cases | 2–5 years | Very High | Disputed liability or catastrophic injury |

Fact: According to The Law Society of England and Wales, over 90% of personal injury claims are settled before reaching trial, often within 6–12 months if liability is admitted early.

Why There’s No Fixed Duration

The process isn’t one-size-fits-all because several key variables determine the pace of your claim:

- Severity of injuries: A sprained ankle heals faster than a spinal injury. Doctors often wait until your condition stabilizes before finalizing medical reports.

- Liability disputes: If the other party denies fault, investigations and negotiations can stretch out for months or even years.

- Insurance response time: Some insurers act promptly; others delay communication or request additional evidence.

- Court involvement: Once legal proceedings begin, the timeline can easily double due to court scheduling and procedures.

So, while it’s tempting to ask your lawyer, “When will I get my settlement?”, even experienced solicitors can only give an estimate, not a guarantee.

Fast-Track vs. Complex Claims

There’s a major distinction between fast-track claims and complex claims.

- Fast-track claims:

These are straightforward cases — for example, a rear-end car accident where fault is clear and injuries are minor. Such cases often resolve within 3–6 months after medical evidence is gathered. - Complex claims:

When the injury is life-changing or when several parties are involved (such as multiple vehicles or employers), the claim enters what’s called the multi-track system. These claims require multiple medical experts, witness statements, and sometimes court hearings — often taking 1–3 years or more.

Real-World Example

Let’s take two hypothetical cases to see how the timelines differ:

Case 1: Minor Car Accident (Fast-Track)

- Accident occurs → Report filed within a week

- Medical assessment → 2–3 weeks

- Insurer admits liability → within 30 days

- Settlement negotiations → 2 months

- Total time: 4–6 months

Case 2: Serious Workplace Injury (Complex Case)

- Accident occurs → Investigation takes 1–2 months

- Long-term medical treatment → 6–12 months before prognosis

- Multiple liability parties (employer + contractor)

- Settlement offers and counteroffers → 6–9 months

- Possible court involvement → adds 12–24 months

- Total time: 2–4 years

This shows how two legitimate claims can differ dramatically in duration based on the circumstances.

How to Estimate Your Timeline

While no two cases are identical, here’s a general guide:

- Minor injuries with clear liability: ~6 months

- Moderate injuries or partial liability dispute: ~12–18 months

- Severe injuries or denied liability: 2–4 years

- Claims requiring trial: 3–5 years

Keep in mind — patience can be profitable. Accepting an early offer before your medical condition stabilizes might result in less compensation than you deserve.

Pro Tip

“Never rush a personal injury claim just to ‘get it over with.’

A well-documented case takes time — but it pays off.”

— Jane Cooper, Senior Personal Injury Solicitor, London

Key Stages of a Personal Injury Claim Process

Understanding the different stages of a personal injury claim can make the process feel far less confusing and stressful. Each step serves a purpose, and delays at one point often ripple through the entire timeline.

Below, we’ll go through every major phase of a typical claim — from the moment the accident happens until the day compensation lands in your account.

1. Reporting the Accident and Seeking Medical Treatment

The first thing to do after an accident is to report it and get medical help immediately. This is important not only for your health but also for your claim.

Medical reports are the foundation of your personal injury case. They prove that your injuries are real, document their severity, and link them directly to the incident. If you delay seeing a doctor, insurers might argue that your injuries weren’t serious or weren’t caused by the accident.

Example:

If you slip in a supermarket and hurt your back but wait a week before visiting the doctor, it gives the insurer room to question whether your injury was related to that fall.

Tip: Always keep copies of all medical reports, prescriptions, X-rays, and receipts. They’re critical evidence later.

Average time: 1–4 weeks

2. Hiring a Personal Injury Solicitor or Lawyer

Next, you’ll want to consult an experienced personal injury solicitor (or lawyer, depending on your country).

A professional can evaluate your case, explain your rights, and manage all the communication with the insurance company.

A good solicitor will:

- Estimate the strength and value of your claim.

- Gather evidence and handle legal paperwork.

- Keep you informed at each step.

In the UK, most people hire lawyers under a No Win, No Fee agreement — meaning you only pay if your claim is successful.

Did You Know?

According to The Legal Ombudsman, claimants with legal representation typically receive up to 30% higher settlements than those who go it alone.

Average time: 1–2 weeks to appoint representation

3. Gathering Evidence and Building the Case

Your solicitor now starts gathering all the information needed to prove liability and quantify damages. This phase is vital — and often the most time-consuming.

Common types of evidence include:

- Police or accident reports

- Photographs or CCTV footage

- Witness statements

- Medical records and expert assessments

- Proof of lost income or expenses

Every document helps strengthen your case. The more complete the evidence package, the smoother the negotiation process later.

Average time: 2–8 weeks

4. Sending a Claim Notification or Letter of Claim

Once your lawyer has the necessary information, they’ll send a Letter of Claim to the other party (often through their insurer).

This formal document outlines:

- The details of the accident

- The injuries sustained

- The reasons for claiming compensation

- The estimated financial losses

After receiving the letter, the other party or their insurer usually has a set period to respond — 21 days in fast-track cases and up to 3 months for complex ones.

During this time, they investigate liability, review evidence, and decide whether to accept or deny responsibility.

Average time: 3–4 months (including insurer’s response window)

5. Liability Investigation and Admission

If the insurer accepts liability, your claim can progress quickly. But if they deny responsibility, things slow down — often requiring further investigation or even court proceedings.

Two possible outcomes:

- Liability admitted: The insurer accepts fault and negotiations begin.

- Liability denied: Your solicitor gathers additional evidence, possibly commissioning expert reports or witness testimony to support your claim.

Real Case Example:

In a 2023 workplace accident case, liability was initially denied because the employer blamed the employee for “not following safety procedures.” After obtaining CCTV footage, it was clear the machine was defective — and the insurer admitted liability, saving months of court delays.

Average time: 2–6 months depending on cooperation level

6. Medical Assessment and Expert Reports

Even if you’ve seen your doctor, insurers typically require an independent medical assessment by an approved expert.

This report confirms:

- The extent of your injuries

- The expected recovery time

- Whether your condition will have long-term effects

For severe injuries, follow-up appointments may be necessary to confirm prognosis. The insurer won’t agree to a final settlement until the medical condition is “stable” — meaning no major change is expected.

Average time: 1–3 months

7. Negotiating Settlement Offers

Once liability and medical evidence are established, settlement negotiations begin.

Your solicitor and the insurer exchange offers and counteroffers until they reach a fair figure. Most claims settle at this stage, without ever going to court.

Factors that influence negotiation time:

- The insurer’s willingness to cooperate

- The accuracy of medical evidence

- The complexity of financial losses (e.g., lost income, future care costs)

Pro Tip:

Never accept the first offer — insurers often start low. Your lawyer will ensure the amount reflects the true impact of your injuries.

Average time: 1–4 months

8. Taking the Claim to Court (If Necessary)

If both sides can’t agree on liability or compensation, your solicitor may issue court proceedings.

This doesn’t always mean a trial — many claims still settle before the hearing date.

However, once legal proceedings begin, prepare for a longer timeline due to:

- Evidence disclosure requirements

- Witness statements

- Expert testimony

- Court scheduling delays

Even after filing, settlement discussions can continue right up to the trial date.

Average time: 1–2 years (from issue to resolution)

Quick Reference Chart

| Stage | Average Duration | Main Activities |

|---|---|---|

| Medical & accident report | 1–4 weeks | Treatment and documentation |

| Hiring solicitor | 1–2 weeks | Legal advice and representation |

| Evidence gathering | 2–8 weeks | Collecting proof and witness statements |

| Letter of claim | 3–4 months | Notification and insurer’s response |

| Liability & investigation | 2–6 months | Acceptance or dispute resolution |

| Medical assessment | 1–3 months | Independent evaluation |

| Negotiation | 1–4 months | Settlement discussions |

| Court proceedings (if needed) | 1–2 years | Litigation and judgment |

Factors That Affect How Long a Personal Injury Claim Takes

Even though the personal injury claim process follows a general structure, the actual time it takes depends on a number of moving parts. Some are within your control — like how quickly you provide documents — and others aren’t, such as insurer response times or medical recovery periods.

Understanding these factors helps set realistic expectations and prevents frustration when things take longer than expected. Let’s explore the main ones.

1. Severity and Type of Injury

The seriousness of your injury has one of the biggest impacts on your claim timeline.

Minor injuries like sprains or bruises heal quickly, allowing for an early medical assessment and settlement. But severe or long-term injuries — such as fractures, head trauma, or spinal damage — can take months or years before doctors can predict the full recovery outcome.

Why does this matter?

Because compensation is based partly on your long-term prognosis. If your condition might worsen or require future treatment, your solicitor will wait until your health stabilizes before settling — ensuring you don’t accept less than you deserve.

Example:

A whiplash claim after a car accident might close in six months, while a brain injury case could remain open for three years due to ongoing rehabilitation.

2. Complexity of Liability

Liability refers to who’s legally at fault.

If it’s obvious — say, you were rear-ended at a red light — things move fast. But if both parties share blame, or multiple people are involved, the investigation stage can drag on.

Complex liability cases may involve:

- Conflicting witness statements

- Missing CCTV footage

- Multiple vehicles or companies

- Technical accident reconstructions

Case Study:

In a 2022 scaffolding collapse case, two construction firms blamed each other. It took 18 months before liability was resolved and settlement talks could begin.

Key takeaway: The clearer the fault, the faster your claim moves.

3. Insurer Response Time

Let’s be honest — insurance companies aren’t known for their speed.

Once they receive the claim notification, they have a legal timeframe (often up to 3 months) to investigate and respond. Some insurers stick to that deadline; others take longer, especially in high-value or disputed claims.

Delays may occur because they:

- Request more medical evidence

- Need additional witness interviews

- Are waiting for police or workplace reports

If your insurer is slow, your solicitor can send reminders or even apply legal pressure — but patience is often required.

Statistic:

According to Financial Conduct Authority (FCA) reports, 1 in 4 personal injury claims experience insurer-related delays.

4. Amount of Compensation Claimed

Generally, the larger the claim, the longer it takes.

Why? Because high-value claims require more evidence to justify the payout — often multiple medical experts, financial reports, and actuarial assessments.

For example:

- A £5,000 soft-tissue injury claim might be settled after one medical exam.

- A £500,000 catastrophic injury claim could need economic loss evaluations and care cost projections over decades.

Insurers also tend to scrutinize larger claims more closely before agreeing to pay.

5. Availability of Medical Evidence

Your case can’t progress until there’s solid medical proof of your injury, treatment, and prognosis. If your doctors are unavailable, slow to send reports, or if you need further tests, this can easily delay things.

Ways to avoid this delay:

- Attend all medical appointments on time.

- Keep copies of all medical paperwork.

- Inform your solicitor if you change doctors or move hospitals.

Pro Tip:

The faster you provide updated medical records, the faster your solicitor can move your claim forward.

6. Court Involvement

When claims can’t be settled out of court, the process slows dramatically.

Court cases involve strict procedural timelines, evidence disclosure, and sometimes months between hearings. Court backlogs — especially post-pandemic — can extend waiting times by a year or more.

However, even after filing, most claims still settle before trial, so going to court doesn’t always mean facing a judge.

Average added time: 12–24 months

7. Claimant’s Cooperation and Communication

You play a bigger role than you might think.

If you respond promptly to your solicitor’s requests, attend medicals, and provide documents quickly, you can cut weeks off your claim’s duration.

Delays often happen when claimants:

- Miss appointments

- Forget to send required forms

- Delay signing documents

Good communication = faster resolution.

Pro Tip: Treat your claim like a project — stay organized, communicate regularly, and follow your lawyer’s advice.

8. Negotiation Willingness

Sometimes both sides agree on liability but disagree on compensation.

Insurers may start with a low offer hoping you’ll settle quickly. If you push back (as you should), negotiations can take several rounds, adding months — but it’s worth it for a fair payout.

Example:

A client initially offered £12,000 for a workplace injury later received £25,000 after further evidence and negotiation — a three-month delay that paid off.

Summary Table: Key Factors and Their Impact

| Factor | Influence on Timeline | Average Delay Range |

|---|---|---|

| Severity of injury | Longer recovery = longer claim | +6–18 months |

| Liability disputes | Additional investigation needed | +3–12 months |

| Insurer response | Slow communication | +1–3 months |

| High compensation amount | More scrutiny and reports | +6–12 months |

| Missing medical evidence | Delayed assessment | +2–6 months |

| Court proceedings | Legal scheduling delays | +12–24 months |

| Claimant cooperation | Faster response = quicker claim | -2–4 months |

How to Speed Up a Personal Injury Claim

Waiting for compensation can feel like watching paint dry — especially when bills, recovery costs, and daily expenses are piling up.

The good news? While you can’t control everything, there are smart, actionable steps you can take to speed up your personal injury claim without compromising on the compensation you deserve.

Below are the most effective ways to keep your claim on track — and out of the slow lane.

1. Gather Evidence Early and Thoroughly

The sooner your solicitor has evidence, the faster your claim can progress. Evidence is the backbone of your case — and missing pieces almost always cause delays.

Here’s what you should collect as soon as possible:

- Accident details: Date, time, and exact location

- Photos and videos: Of the scene, vehicles, or unsafe conditions

- Witness details: Names and contact numbers

- Police or incident reports

- Medical documents and receipts

- Proof of lost earnings or out-of-pocket costs

Pro Tip: Use your phone to take photos immediately after the incident — even small details like weather conditions or broken floor tiles can make a big difference later.

Example:

A client who photographed a defective stair rail right after falling down it had her claim settled 3 months earlier than average because liability was proven instantly.

2. Respond Promptly to Your Solicitor

Your solicitor will often need your input — from signing documents to confirming appointment dates or providing information.

Every time you delay responding, the clock stops ticking on your case.

Speed Tip:

- Reply to emails within 24 hours where possible.

- Keep digital copies of important documents handy.

- Use secure apps or portals if your law firm offers them.

Think of it as teamwork — your solicitor handles the legal maze, but your responsiveness keeps the wheels turning.

3. Attend All Medical Appointments on Time

Missing medical appointments is one of the most common (and preventable) causes of delay.

Each missed visit means rescheduling, waiting for new reports, and sometimes months of lost progress.

Be proactive:

- Don’t cancel unless absolutely necessary.

- Bring notes about how your injury affects daily life — this helps doctors create more accurate reports.

- If your symptoms worsen, inform your solicitor immediately — it may change the claim’s value.

Did You Know?

In the UK, insurers rely heavily on independent medical experts, and late medical reports are responsible for nearly 20% of all personal injury claim delays (based on APIL 2024 data).

4. Choose the Right Personal Injury Solicitor

A well-organized and experienced solicitor can mean the difference between a 6-month and a 2-year claim.

Look for lawyers who specialize in personal injury and have strong relationships with insurers and medical experts — it can streamline communication and negotiation.

Checklist for choosing a solicitor:

- Proven track record in your type of injury

- Clear communication (no legal jargon overload)

- Positive client reviews

- Transparent fee structure

- Availability and responsiveness

“A good solicitor doesn’t just handle paperwork — they anticipate problems before they cause delays.”

— John K. Lewis, Personal Injury Specialist, Manchester

5. Keep All Records Organized

A cluttered file equals a slow claim.

Create a simple folder — digital or physical — for everything related to your case:

- Accident reports

- Medical reports and receipts

- Employment and income documents

- All correspondence from your solicitor and insurer

This not only helps your lawyer but also makes you feel more in control of your progress.

Bonus Tip:

Use Google Drive, Dropbox, or OneDrive to store your files securely online. That way, you can share them instantly when your solicitor requests updates.

6. Avoid Rushing to Settle Too Soon

It’s natural to want your compensation fast — but settling before your medical condition has stabilized can backfire.

If your symptoms later worsen, you can’t reopen the claim once you’ve accepted an offer.

Instead:

- Wait until doctors confirm you’ve reached “maximum medical improvement.”

- Ask your solicitor to estimate potential future losses (like ongoing physiotherapy or reduced work capacity).

- Decline early “lowball” offers — insurers often test your patience.

Example:

A claimant with a shoulder injury accepted an early £7,000 offer. Six months later, she required surgery costing £5,000 — which she had to pay herself. Waiting would have doubled her compensation.

7. Use Technology to Track and Communicate

Many modern law firms offer client portals or case tracking apps where you can:

- Upload documents instantly

- Receive notifications on case progress

- Chat securely with your solicitor

Using these systems keeps everything organized and transparent, reducing back-and-forth delays.

8. Stay Honest and Consistent

Exaggerating injuries or providing inconsistent information can cause insurers to pause investigations. Always be truthful — even if it means admitting you’ve improved faster than expected.

Honesty speeds up the process because it builds credibility.

Once insurers trust the evidence, they’re far less likely to request extra documentation or investigations.

9. Mediation and Early Settlement Meetings

If negotiations stall, your solicitor might recommend mediation — a faster, less formal way to resolve disputes than court.

Both parties meet (often virtually) with an independent mediator who helps them find middle ground.

Fact:

According to Civil Mediation Council UK, over 75% of mediated personal injury claims reach a successful settlement within 1–2 sessions.

It’s not always suitable, but when it works, it can save months or even years of court delays.

10. Maintain Regular Check-ins

Don’t be afraid to ask your solicitor for monthly updates. You’re not being a nuisance — you’re ensuring accountability.

A simple, polite follow-up can sometimes push your case forward, especially if it’s waiting on external responses.

Summary: Proven Ways to Speed Up Your Personal Injury Claim

| Action | Impact on Timeline | Estimated Time Saved |

|---|---|---|

| Gather evidence quickly | Prevents early delays | 1–2 months |

| Respond promptly | Keeps claim moving | 2–4 weeks |

| Attend medicals | Avoids rescheduling | 1–3 months |

| Hire experienced solicitor | Ensures efficiency | 3–6 months |

| Stay organized | Faster document processing | 2–4 weeks |

| Mediation | Avoids lengthy trials | 6–12 months |

How Long Does It Take to Settle Out of Court?

Most personal injury claims don’t end up in a courtroom drama with lawyers shouting “Objection!” — instead, they’re quietly settled out of court, usually through negotiation between your solicitor and the other party’s insurance company.

This approach is faster, less stressful, and often more cost-effective. But how long does it actually take?

Let’s break it down.

Average Timeframe for Out-of-Court Settlements

While every case is different, here’s a general timeline based on data from UK, US, and EU personal injury markets:

| Type of Injury Claim | Average Settlement Time (Out of Court) | Notes |

|---|---|---|

| Minor whiplash / soft tissue | 3–6 months | Straightforward liability, minimal medical treatment |

| Moderate injury (fractures, sprains) | 6–12 months | Needs medical evidence and proof of lost income |

| Serious injury (surgery, long-term effects) | 12–24 months | Requires complex expert reports and higher compensation |

| Catastrophic or life-altering injury | 2–3 years+ | May involve ongoing care and multiple specialists |

Quick Fact:

According to the Law Society Gazette, over 92% of UK personal injury claims are settled out of court — most within 6 to 12 months after medical reports are finalized.

Why Settling Out of Court Is Faster

Settling out of court eliminates several time-consuming stages:

- No court backlog — you avoid waiting months for hearing dates.

- Less paperwork — no formal pleadings or discovery deadlines.

- Direct negotiation — insurers often prefer to settle early to avoid legal costs.

- Flexibility — both sides can adjust offers in real time.

In many cases, once medical evidence and liability are clear, insurers make a “Part 36 offer” (in the UK system) or settlement proposal (in US law), and negotiations begin immediately.

Example:

A cyclist hit by a car in Birmingham received a £25,000 settlement 9 months after the accident — primarily because both parties agreed early on liability and medical evidence was straightforward.

What Can Delay an Out-of-Court Settlement

While faster than court proceedings, certain factors can still slow things down:

- Disputed liability: If the other side denies fault, negotiations can stall.

- Incomplete medical evidence: Claims can’t finalize until your recovery stabilizes.

- Lowball offers: Insurers often test your patience with undervalued first offers.

- Unresponsive parties: Delays from the insurer or medical experts can add months.

- Multiple parties involved: e.g., multi-vehicle accidents or employer liability cases.

Pro Tip:

If you receive a low settlement offer, don’t panic — your solicitor can make a counteroffer with supporting medical evidence and proof of losses. Most insurers respond within 2–3 weeks.

Advantages of Settling Out of Court

| Benefit | Description |

|---|---|

| Faster resolution | Often completed within 6–12 months |

| Lower costs | Fewer legal fees and no court expenses |

| Less stress | No formal hearings or testimonies |

| More control | You decide whether to accept or reject offers |

| Privacy | Settlements remain confidential, unlike court judgments |

Real-world Insight:

A 2024 study by APIL found that claimants who settled out of court were, on average, paid 4 months sooner than those whose cases proceeded to trial — with nearly identical compensation amounts.

When You Should Not Settle Out of Court

Sometimes, patience pays. You might need to take your claim to court if:

- The insurer refuses to admit liability despite clear evidence.

- The offer is significantly below what your solicitor estimates as fair.

- Your injuries are still evolving, and the long-term impact is uncertain.

- There’s a policy dispute between multiple insurers.

Settling too early might close your case before your full losses are known.

Always rely on your solicitor’s advice — they can weigh the pros and cons of waiting for a better offer versus proceeding to litigation.

Negotiation Strategy: How to Reach Settlement Faster

Your solicitor will usually follow these steps for efficient negotiation:

- Submit a detailed claim letter with medical reports and loss calculations.

- Wait for the insurer’s liability response (usually 3 months in UK law).

- Exchange settlement proposals and counteroffers.

- Agree on a final figure and sign a settlement agreement.

- Receive payment, typically within 21–28 days after agreement.

Example Timeline:

| Stage | Duration |

|---|---|

| Claim notification | 1 week |

| Insurer investigation | 3 months |

| Medical examination | 1–2 months |

| Negotiation & final offer | 2–3 months |

| Payment issued | 1 month |

Total Estimated Time: 6–9 months (average out-of-court settlement)

Factors That Can Delay a Personal Injury Claim

You’ve probably heard the saying, “Good things take time.”

Unfortunately, that’s especially true for personal injury claims — but not always for good reasons.

While some delays are unavoidable (like waiting for medical recovery), others are caused by miscommunication, missing documents, or even insurer tactics designed to slow things down.

Understanding these roadblocks helps you stay prepared — and gives you the power to prevent unnecessary waiting.

1. Disputed Liability

One of the biggest causes of delay is when the other party (or their insurer) refuses to admit fault.

Example:

Imagine you were rear-ended in traffic. You know it wasn’t your fault — but the other driver claims you stopped suddenly.

Until liability is agreed upon, insurers won’t process or pay the claim.

Impact on timeline:

- Adds 3–6 months or more to the case.

- May require witness statements, CCTV footage, or expert accident reconstruction reports.

How to prevent it:

Gather as much evidence as possible early — photos, police reports, dashcam footage, and witness information all help your solicitor establish fault quickly.

Pro Tip: The clearer your liability evidence, the faster your case moves through insurance negotiations.

2. Severity and Recovery Time of Injuries

Your medical condition plays a huge role in the timeline.

Claims can’t be settled until doctors know the full extent of your injuries — including any long-term effects or future treatment costs.

Minor injuries: may resolve in weeks, allowing early settlement.

Serious injuries: (e.g., fractures, spinal damage) may take months or years to assess fully.

Why it matters:

If you settle before your condition stabilizes, you might miss out on compensation for future care or lost income.

“Never rush medical recovery for the sake of a quicker payout — insurers love that mistake.”

— Rachel H., Personal Injury Lawyer, London

3. Waiting for Medical Reports

Even after treatment ends, it takes time for medical experts to write official reports.

In busy systems like the NHS, this step can add 4–8 weeks — sometimes more if specialists are involved.

What you can do:

- Attend all appointments on time.

- Ask your solicitor to request updates from experts.

- Provide any personal medical notes or updates to speed things up.

4. Insurer Delays

Insurance companies are not known for their lightning-fast responses.

Sometimes, they intentionally drag out negotiations, hoping claimants will settle for less out of frustration.

Common delay tactics include:

- Requesting unnecessary documents

- Taking weeks to reply to letters

- Making “without prejudice” low offers

- Requiring multiple levels of approval

Average delay: 1–3 months (or longer for large claims)

Solution:

A proactive solicitor can apply legal pressure — for instance, by setting strict response deadlines or threatening formal proceedings if insurers don’t cooperate.

5. Incomplete or Missing Documents

Even small paperwork errors can stop your claim cold.

Missing pay slips, incomplete accident reports, or unsigned forms often lead to weeks of back-and-forth communication.

Checklist of essential documents:

- Police or incident report

- Medical records and receipts

- Employer confirmation of lost income

- Photographs and witness statements

- Signed consent forms

Keeping these ready from day one ensures no stage of your claim gets stuck in administrative limbo.

6. Changes in Legal Representation

If you switch solicitors mid-claim, expect a temporary pause while your new lawyer reviews the file and requests documents from your previous firm.

This transition can delay progress by 4–6 weeks, depending on cooperation.

Advice:

Choose your solicitor carefully at the beginning. Consistency saves time and maintains case momentum.

7. Court Backlog (If Litigation Becomes Necessary)

Although most cases settle out of court, a small percentage end up before a judge. Unfortunately, court systems often have significant backlogs — especially since the pandemic.

Estimated delay:

- 6–12 months for hearing dates (sometimes longer).

Fact:

In 2024, UK county courts reported a backlog of over 60,000 civil cases, with personal injury trials among the slowest to schedule (source: Justice UK Annual Report).

8. Multiple Parties or Complex Claims

Accidents involving several parties — such as multi-vehicle crashes, construction site injuries, or employer negligence cases — require each insurer to investigate and respond.

The more people involved, the slower it gets.

Example:

A workplace scaffolding collapse involving three subcontractors took 2.5 years to resolve due to disputes over who was responsible.

Solution:

An experienced solicitor can coordinate communication among insurers, keeping the process as efficient as possible.

9. Late Disclosure of Evidence

Sometimes, crucial information surfaces late — like additional medical evidence, new witness statements, or financial loss documents.

Each update triggers re-evaluation by insurers and experts, prolonging negotiations.

Prevent this by:

- Submitting everything early.

- Keeping a checklist of all requested evidence.

- Promptly informing your solicitor of any new developments.

10. Claimant’s Own Delays

Yes — sometimes the holdup comes from the claimant.

Missing appointments, not replying to messages, or delaying document submissions all add up over time.

Example:

Failing to send proof of earnings for three months delayed one client’s compensation by five additional months.

Simple fix:

Stay organized and maintain regular contact with your solicitor. Treat your claim like a shared project — because it is.

Summary Table: Common Causes of Delay

| Cause of Delay | Estimated Added Time | How to Avoid It |

|---|---|---|

| Disputed liability | 3–6 months | Gather strong evidence early |

| Severe injuries | 6–18 months | Wait for full recovery, but monitor progress |

| Late medical reports | 1–2 months | Attend appointments, follow up |

| Insurer tactics | 1–3 months | Hire assertive solicitor |

| Missing documents | 1 month | Keep organized files |

| Changing solicitor | 1–2 months | Choose carefully from start |

| Court backlog | 6–12 months | Try out-of-court settlement |

| Multiple parties | 3–6 months | Maintain clear communication |

| Late evidence | 1–2 months | Submit early |

| Claimant delays | 1–3 months | Stay responsive and proactive |

How Long Does It Take to Receive Compensation After Settlement?

Reaching a settlement feels like crossing the finish line — but before you pop the champagne, there’s one final step: actually receiving your compensation.

The good news? Once both parties agree on a settlement, the payment process is usually fairly quick — provided all the paperwork is complete and no last-minute issues arise.

Let’s break down what happens next.

1. Standard Compensation Payment Timeline

After your case is settled (either out of court or through a court order), the defendant — typically an insurance company — must pay the agreed amount within a specific period.

In most cases:

- UK law (Civil Procedure Rules, Part 36) requires payment within 14 to 28 days after the settlement agreement or court order.

- In the US, most states follow a 30–60 day payment window.

- For EU-based claims, insurers are generally required to pay within 30 days after final documentation.

| Location | Average Payment Timeline | Legal Reference |

|---|---|---|

| United Kingdom | 14–28 days | Civil Procedure Rules (CPR Part 36.14) |

| United States | 30–60 days | Varies by state |

| European Union | 30 days | EU Insurance Claims Directive |

| Canada | 2–4 weeks | Provincial injury laws |

Quick Fact:

According to the Law Society Gazette, over 80% of UK claimants receive their compensation within 21 days after signing the settlement agreement.

2. The Step-by-Step Post-Settlement Process

Here’s what happens after you accept a settlement offer:

- Settlement Agreement Signed

Both parties sign a formal document outlining the terms of the settlement, including the compensation amount and any conditions. - Defendant Receives Payment Instructions

Your solicitor provides bank details or a trust account where the payment will be sent. - Payment Processed by Insurer or Defendant

The defendant’s finance department initiates payment. Most do this electronically to avoid delays. - Funds Transferred to Your Solicitor’s Account

Compensation is typically paid into your solicitor’s client trust account for security and verification. - Deductions Made (If Applicable)

Your solicitor deducts any agreed legal fees, medical report costs, or interim payments. - Final Payment Sent to You

Once cleared, your solicitor transfers the remaining balance to your personal bank account.

Total estimated time:

Usually 2 to 4 weeks after signing the settlement agreement — unless complications arise.

3. Why Payment Might Be Delayed

Even after settlement, delays can occur due to:

- Administrative errors: Incorrect banking details or missing documents.

- Insurer processing delays: Payment departments may have backlogs.

- Court involvement: If the case settled through a court order, extra verification may be required.

- Third-party deductions: For example, if medical bills, insurance liens, or child support arrears must be paid first.

- Bank clearance times: International transfers or large sums can take longer to clear.

Pro Tip:

Always confirm your solicitor has up-to-date bank details and provide written authorization for fund transfers to prevent hold-ups.

4. What If the Defendant Fails to Pay on Time?

If payment doesn’t arrive by the agreed date, your solicitor can take legal enforcement action.

In the UK, this usually means:

- Sending a formal notice to the insurer, and if ignored —

- Applying for a Judgment Debt or Warrant of Execution, which legally compels payment.

In rare cases, interest may also be added for late payment under Section 17 of the Judgments Act 1838 (UK).

Example:

A claimant’s insurer delayed payment for 45 days. The solicitor filed a late-payment notice, and the insurer had to pay interest at 8% per annum on the overdue amount — plus court costs.

5. How Solicitors Handle the Compensation Release

Most law firms have a transparent process for releasing funds.

Here’s how it works:

| Stage | Action | Average Duration |

|---|---|---|

| Funds received from insurer | Payment verified in client account | 1–3 days |

| Deductions processed | Legal fees, medical costs deducted | 2–5 days |

| Final balance transfer | Payment to claimant | 1–2 days |

Total time once funds are received: About 1 week.

If your solicitor operates a “No Win, No Fee” agreement, deductions (typically 20–25%) are taken before transferring the final amount.

6. Example Timeline: From Settlement to Payout

| Stage | Timeframe |

|---|---|

| Settlement agreed | Day 0 |

| Settlement documents signed | Within 3 days |

| Defendant processes payment | Within 14–21 days |

| Solicitor receives funds | Day 21–28 |

| Deductions processed | Day 28–32 |

| Final compensation paid to you | Day 32–35 |

Total: 4–5 weeks after settlement

7. What If You’re Still Waiting After 30 Days?

If your payment hasn’t arrived:

- Contact your solicitor for an update.

- Ask whether the defendant has confirmed transfer.

- Request written proof of any delay explanation.

- If no response, your solicitor can send a Letter Before Action to compel payment.

In most cases, once legal pressure is applied, insurers respond quickly.

Common Mistakes That Can Delay Your Personal Injury Claim (and How to Avoid Them)

Even small errors can turn a straightforward personal injury claim into a long, frustrating process.

Knowing the most common mistakes — and how to avoid them — is essential if you want to shorten your claim timeline and maximize compensation.

1. Delaying Medical Attention

Mistake: Waiting too long to see a doctor after an accident.

Why it causes delays:

- Insurers may question whether the injury is genuine or linked to the accident.

- Late medical documentation delays the evidence-gathering stage.

How to avoid it:

- Seek medical care immediately.

- Keep detailed records of every appointment, diagnosis, and treatment.

- Save all receipts and reports to submit to your solicitor promptly.

Pro Tip: Even minor injuries should be documented — a seemingly small sprain can have long-term consequences.

2. Not Hiring a Qualified Personal Injury Solicitor

Mistake: Attempting to handle a claim without professional legal support.

Why it causes delays:

- You may miss important deadlines or paperwork.

- Insurers can exploit inexperience to slow negotiations.

- Court procedures (if required) are complex and time-consuming.

How to avoid it:

- Choose a solicitor with experience in personal injury claims.

- Check reviews, track records, and No Win, No Fee arrangements.

- Confirm they specialize in your type of injury.

Insight: According to APIL, legally represented claimants often receive 30% higher settlements and experience fewer delays.

3. Failing to Provide Complete Evidence

Mistake: Submitting incomplete documentation, missing photos, or insufficient proof of losses.

Why it causes delays:

- Solicitors and insurers must repeatedly request missing information.

- Investigation stages are prolonged, especially for disputed liability.

How to avoid it:

- Gather accident photos, witness statements, and police reports immediately.

- Keep copies of all medical records and financial losses.

- Use a checklist provided by your solicitor to ensure nothing is overlooked.

4. Ignoring Communication from Your Solicitor

Mistake: Not responding promptly to emails, calls, or document requests.

Why it causes delays:

- Your solicitor can’t move forward without your input.

- Key deadlines may be missed, causing the insurer to pause the claim.

How to avoid it:

- Respond within 24–48 hours whenever possible.

- Keep your contact information up to date.

- Use secure communication methods recommended by your solicitor.

Tip: Think of your solicitor as a teammate — your responsiveness directly affects how quickly your claim progresses.

5. Settling Too Early

Mistake: Accepting the first settlement offer without full medical evidence or legal advice.

Why it causes delays or loss:

- Settling too soon may result in lower compensation.

- If injuries worsen later, you cannot reopen the claim.

How to avoid it:

- Wait until your injuries are fully assessed and prognosis is clear.

- Discuss the offer thoroughly with your solicitor.

- Ensure all future costs, lost income, and ongoing treatment are considered.

Example:

A client accepted a £10,000 offer for a shoulder injury, only to need surgery later — missing out on an additional £15,000 in compensation.

6. Mismanaging Financial Records

Mistake: Failing to track lost wages, receipts, or additional expenses related to the injury.

Why it causes delays:

- Claimants must provide proof for compensation calculation.

- Missing records require follow-up, which slows negotiations.

How to avoid it:

- Maintain a dedicated folder for all receipts, invoices, and financial documents.

- Document lost wages and any out-of-pocket costs promptly.

- Keep copies for your solicitor to submit to the insurer.

7. Ignoring Instructions from Your Solicitor

Mistake: Not following advice regarding medical appointments, evidence submission, or legal procedures.

Why it causes delays:

- Deviating from your solicitor’s plan may result in errors or repeated steps.

- Insurers may challenge incomplete or inconsistent evidence.

How to avoid it:

- Treat your solicitor’s guidance seriously.

- Ask questions if anything is unclear, but follow the agreed plan.

- Attend all scheduled appointments and meetings.

8. Failing to Track the Claim Progress

Mistake: Not keeping track of deadlines, medical assessments, or insurer communications.

Why it causes delays:

- Opportunities to push the claim forward are missed.

- Follow-ups with insurers or medical experts can be forgotten.

How to avoid it:

- Use a simple calendar or digital tracker.

- Schedule reminders for appointments, document submissions, and follow-ups.

- Ask your solicitor for regular updates and a progress summary.

9. Not Preparing for Multiple Parties or Complications

Mistake: Underestimating the complexity of cases with multiple parties (e.g., car accidents involving several drivers, construction site injuries).

Why it causes delays:

- Each party and insurer must investigate and respond.

- Liability disputes are more common in multi-party claims.

How to avoid it:

- Work closely with your solicitor to gather evidence from all parties.

- Ensure every involved insurer or company is notified promptly.

- Expect longer timelines and plan accordingly.

10. Lack of Patience

Mistake: Pushing for a settlement before the process is complete or becoming disengaged due to frustration.

Why it causes delays:

- Rushed claims risk accepting inadequate compensation.

- Frustration may lead to missed deadlines or errors in submissions.

How to avoid it:

- Understand the typical timeline for your type of injury.

- Trust your solicitor to manage the process efficiently.

- Stay organized and proactive while exercising patience.

Summary Table: Mistakes and Preventive Actions

| Common Mistake | Impact | How to Avoid It |

|---|---|---|

| Delaying medical attention | Disputed injury & delayed evidence | See doctor immediately & keep records |

| Not hiring a solicitor | Errors, missed deadlines | Choose experienced personal injury lawyer |

| Incomplete evidence | Slow investigation | Gather full documentation upfront |

| Ignoring solicitor | Pauses claim progress | Respond promptly & stay engaged |

| Settling too early | Reduced compensation | Wait for full medical assessment |

| Poor financial records | Lost compensation | Track all expenses & lost wages |

| Ignoring instructions | Errors in claim | Follow solicitor’s advice carefully |

| Not tracking claim | Missed deadlines | Use calendar & regular updates |

| Underestimating complexity | Disputes, delays | Plan for multi-party involvement |

| Lack of patience | Mistakes & stress | Understand timeline & stay proactive |

Frequently Asked Questions (FAQs)

Q1: How long does a personal injury claim usually take?

A: Most claims are resolved in 6–12 months if settled out of court. Minor injuries may take 3–6 months, while severe or complex cases can take 2–3 years.

Q2: What factors affect how long a personal injury claim takes?

A: Key factors include the severity of your injury, complexity of liability, insurer response time, medical evidence availability, and whether the case goes to court.

Q3: Can I speed up my personal injury claim?

A: Yes. Hire an experienced solicitor, provide complete medical evidence, respond promptly to requests, attend all medical appointments, and stay organized to minimize delays.

Q4: How long does it take to receive compensation after settlement?

A: Typically 2–4 weeks after signing the settlement agreement, though delays may occur due to administrative errors, insurer processing, or third-party deductions.

Q5: Why does it take so long to settle some personal injury claims?

A: Common reasons include disputed liability, late medical reports, insurer delays, complex multi-party claims, and waiting for full medical recovery.

Q6: Should I settle my claim early to get money faster?

A: Not always. Settling too early can result in lower compensation or leaving out future medical costs. Always wait for your solicitor’s guidance and complete medical assessments.

Q7: Do most personal injury claims go to court?

A: No. Over 90% of claims are settled out of court. Court proceedings are usually only necessary when liability is disputed or settlement negotiations fail.

Conclusion: How Long Does a Personal Injury Claim Take Overall?

After exploring every stage — from the moment an accident occurs to receiving your compensation — it’s clear that there’s no one-size-fits-all timeline for personal injury claims.

The total duration depends on several factors:

- Severity of your injuries

- Complexity of liability

- Insurer response time

- Quality and speed of evidence collection

- Whether the case settles out of court or goes to litigation

Average Timelines Based on Claim Type

| Claim Type | Average Duration |

|---|---|

| Minor injuries (soft tissue, sprains) | 3–6 months |

| Moderate injuries (fractures, surgery) | 6–12 months |

| Serious injuries (long-term effects) | 12–24 months |

| Catastrophic injuries (life-altering, multiple parties) | 2–3 years+ |

Insight: The majority of claims are resolved out of court, often in the 6–12 month range, making the process significantly faster than litigation.

Key Takeaways for Faster Resolution

- Seek medical attention immediately — Document every detail.

- Hire an experienced personal injury solicitor — They streamline communication and negotiations.

- Provide complete and timely evidence — Photos, witness statements, medical reports, and financial losses.

- Stay responsive and organized — Answer your solicitor promptly and track all deadlines.

- Avoid rushing settlements — Wait for full medical recovery and legal guidance.

- Expect realistic timelines — Understand that serious or complex cases naturally take longer.

By following these steps, you can minimize delays and ensure your claim progresses efficiently, while maximizing the compensation you deserve.

A personal injury claim is a process — sometimes slow, sometimes complex — but knowledge and preparation make all the difference.

While it’s natural to want a quick resolution, patience paired with proactive action ensures a fair settlement and reduces unnecessary frustration.

“Time in a personal injury claim is inevitable, but wasted time is optional.”

Remember: staying organized, responsive, and well-informed is the fastest path to getting your compensation.

Additional Resources & References

- Association of Personal Injury Lawyers (APIL) – https://www.apil.org.uk/

Comprehensive guidance on personal injury claims, settlement timelines, and solicitor advice. - Civil Procedure Rules (CPR Part 36) – UK – https://www.justice.gov.uk/courts/procedure-rules/civil/rules/part36

Official rules governing out-of-court settlements and timelines. - Civil Mediation Council (CMC UK) – https://civilmediation.org/

Information on mediation benefits and alternative dispute resolution for personal injury claims. - Justice UK Annual Report – https://www.gov.uk/government/publications/justice-annual-report

Data on court backlog, litigation, and civil case timelines. - Law Society Gazette – https://www.lawgazette.co.uk/

Industry insights on claim settlements, legal advice, and case studies. - Financial Conduct Authority (FCA) – https://www.fca.org.uk/

Regulatory information on insurers and payout practices. - Civil Justice Council – Personal Injury Claims – https://www.judiciary.uk/related-offices-and-bodies/advisory-bodies/cjc/

Research on delays, settlement times, and dispute resolution. - British Medical Association – Accident & Injury Reports – https://www.bma.org.uk/advice-and-support

Guidance on medical evidence and documentation for claims. - Civil Justice Statistics (UK Ministry of Justice) – https://www.gov.uk/government/collections/civil-justice-statistics

Official statistics on claim duration, court cases, and outcomes.